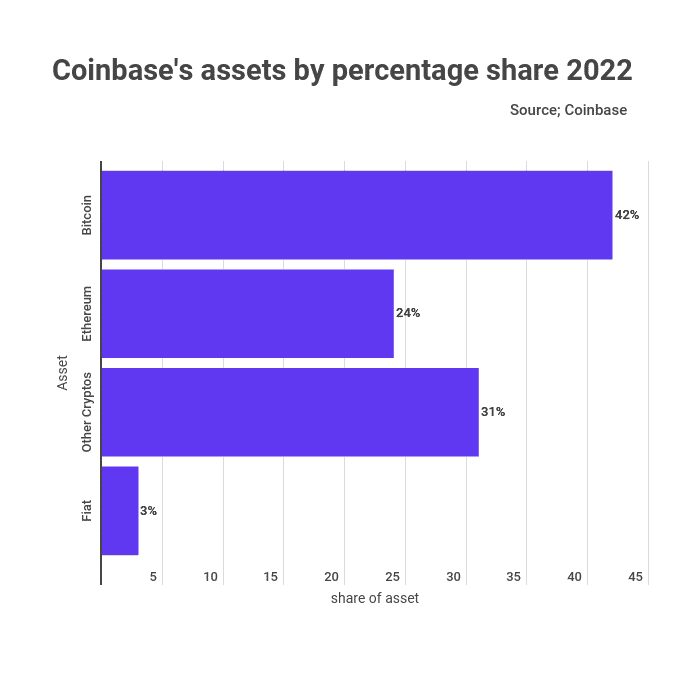

TradingPlatforms has been studying Coinbase’s 2022 results, highlighting the proportion of cryptocurrencies making its assets. It concludes that 42% of the crypto exchange’s assets are in Bitcoin (BTC). That’s a slight increase from Q4 2021, when 40% of assets were in the crypto.

TradingPlatforms’ financial lead Edith Reads has been sharing her thoughts on the data. She affirms,

“Coinbase has always held Bitcoin and other cryptos since inception. It has done so driven by its firm belief in BTC’s and the cryptoeconomy’s long-term potential.”

Coinbase’s Declining Market Share

Coinbase’s total assets amounted to $256 billion in the period. That figure was a $22 billion decline from its Q4 2021 total of $278 billion. The firm attributes that drop to a fall in the prices of crypto assets. That said, net inflows amounting to billions of dollars cushioned it from bigger losses.

As the overall market capitalization of crypto assets declined in Q4, Coinbase saw a corresponding decline in its market share. But, the decrease was more pronounced for assets highly represented on its platform, such as ETH and SOL.

The crypto exchange’s transaction revenue also dipped in Q1, falling 56% compared to Q4. However, though transaction revenue dipped, it still made up most of Coinbase’s quarterly net earnings.

Additionally, retail transaction revenue ($966M) was down 56% from Q42021. Again, transaction revenue from institutional investors was $47 million in Q1, down 48% from Q4. The main driver of this decline was a change in the fee structure for market makers.

Coinbase is Optimistic of a Bright Future

Despite declining transaction revenue, Coinbase is seeing continued growth in its user base. This suggests that there is still strong demand for cryptocurrencies that Coinbase is well-positioned to capitalize on.

The new fee structure caused a significant decline in Coinbase’s institutional fee rate. But the firm continued to see strong demand from market makers. That uptick helped offset some of the losses in institutional volume.

Another bright spot was that the exchange attracted increased participation in staking.